VAT Flat Rate Scheme Calculator for Fast & Accurate Results

What is the Flat Rate Scheme? A simplified VAT scheme for small businesses with turnover below £150,000 (excluding VAT).

How does it work? You pay a fixed percentage of your turnover to HMRC, based on your business type. You cannot reclaim VAT on purchases (except capital assets over £2,000).

Pay a fixed rate on VAT-inclusive turnover under the VAT Flat Rate Scheme. Skip tracking input vs output VAT on every sale and purchase.

Best for service-heavy firms with low goods spend. Not ideal if your input VAT is high.

Run the VAT Flat Rate Calculator to see your bill now, and many users also use our VAT Calculator when they need quick add-or-remove VAT steps for daily costs.

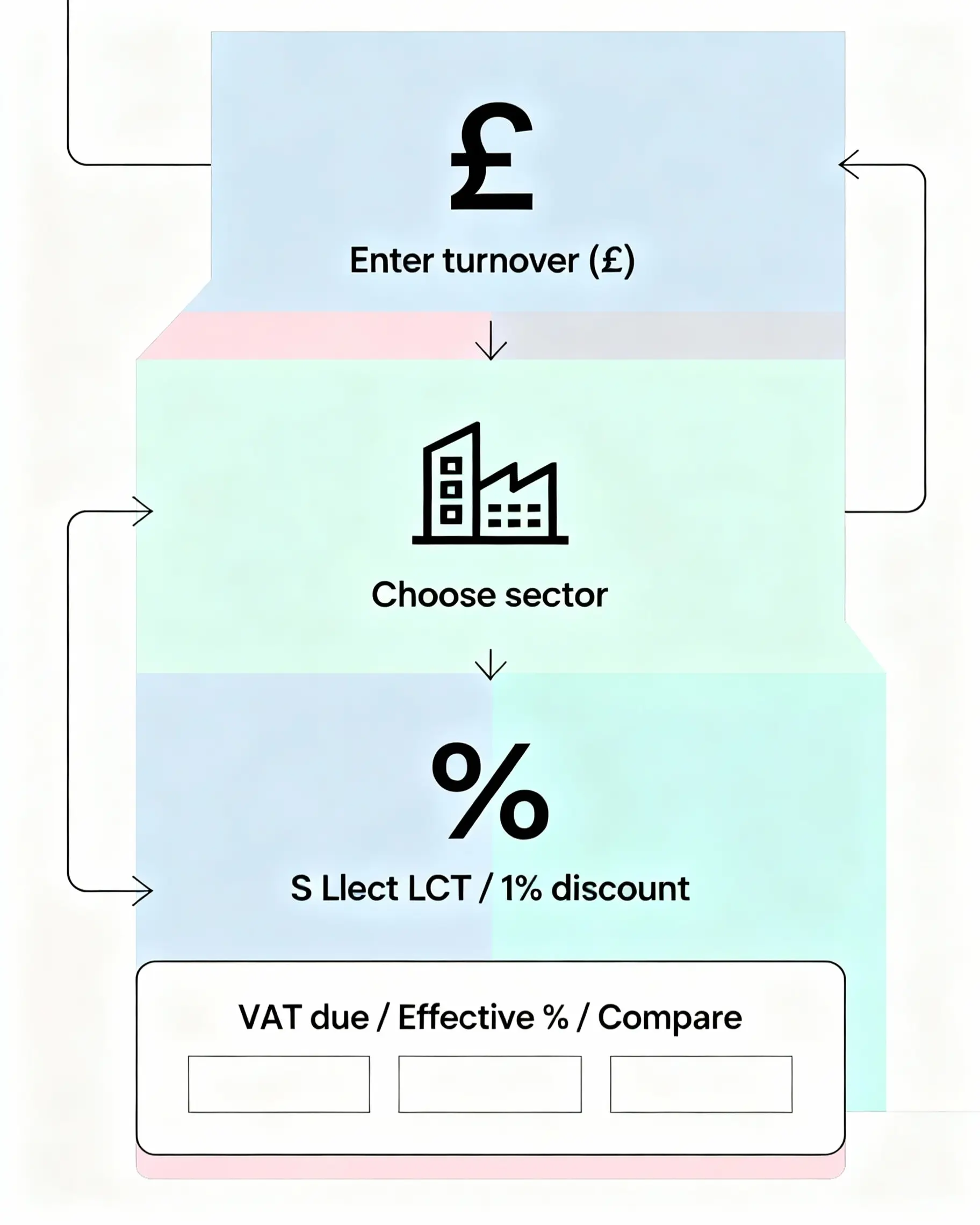

Quick VAT Flat Rate Scheme Calculator

Use this simple tool to estimate your VAT under the Flat Rate Scheme. Enter your VAT-inclusive turnover, choose your business sector, and select if you're a limited-cost trader or qualify for the 1% first-year discount. Many users also read VAT Refund UK Tourist to understand how refunds work when shopping or traveling in the UK.

You'll see:

- VAT due under the Flat Rate Scheme

- A comparison with Standard VAT

- Your effective VAT percentage

- Notes on reclaiming VAT for capital goods worth £2,000 or more

💡 Tip

Always enter your total sales, including VAT, for the most accurate result. Used correctly, the VAT Flat Rate Scheme calculator view helps you sanity-check quarterly figures fast.

If you need to calculate standard VAT rates first, try our main VAT calculator for quick add or remove VAT calculations, and you can also read How to Use the VAT Calculator UK if you want simple steps for using the tool.

What is the VAT Flat Rate Scheme?

The VAT Flat Rate Scheme (FRS) is a simpler way for small UK businesses to pay VAT. You still charge VAT to your customers at the normal rate, but instead of calculating the difference between input and output VAT, you pay HMRC a fixed percentage of your total VAT-inclusive sales.

Each business sector has its own flat rate — for example, accountants pay 14.5%, IT consultants 14.5%, and caterers 12.5%. Most businesses can't reclaim input VAT, except on a single capital purchase worth £2,000 or more, such as a van or computer package. Many people also search How to Work Out VAT in the UK when they want a simple breakdown of how these rates and rules fit into real calculations.

Learn more about VAT fundamentals and tax management strategies to help you make informed decisions for your business.

Example

If your VAT-inclusive turnover for the quarter is £1,200, and your flat rate is 11%, you'll pay HMRC:

£1,200 × 11% = £132

That's your total VAT due for the period — no long calculations or receipt matching needed.

Summary:

- •Charge VAT to customers as usual

- •Pay HMRC a fixed rate based on your sector

- •Usually can't reclaim input VAT, except for one capital purchase over £2,000

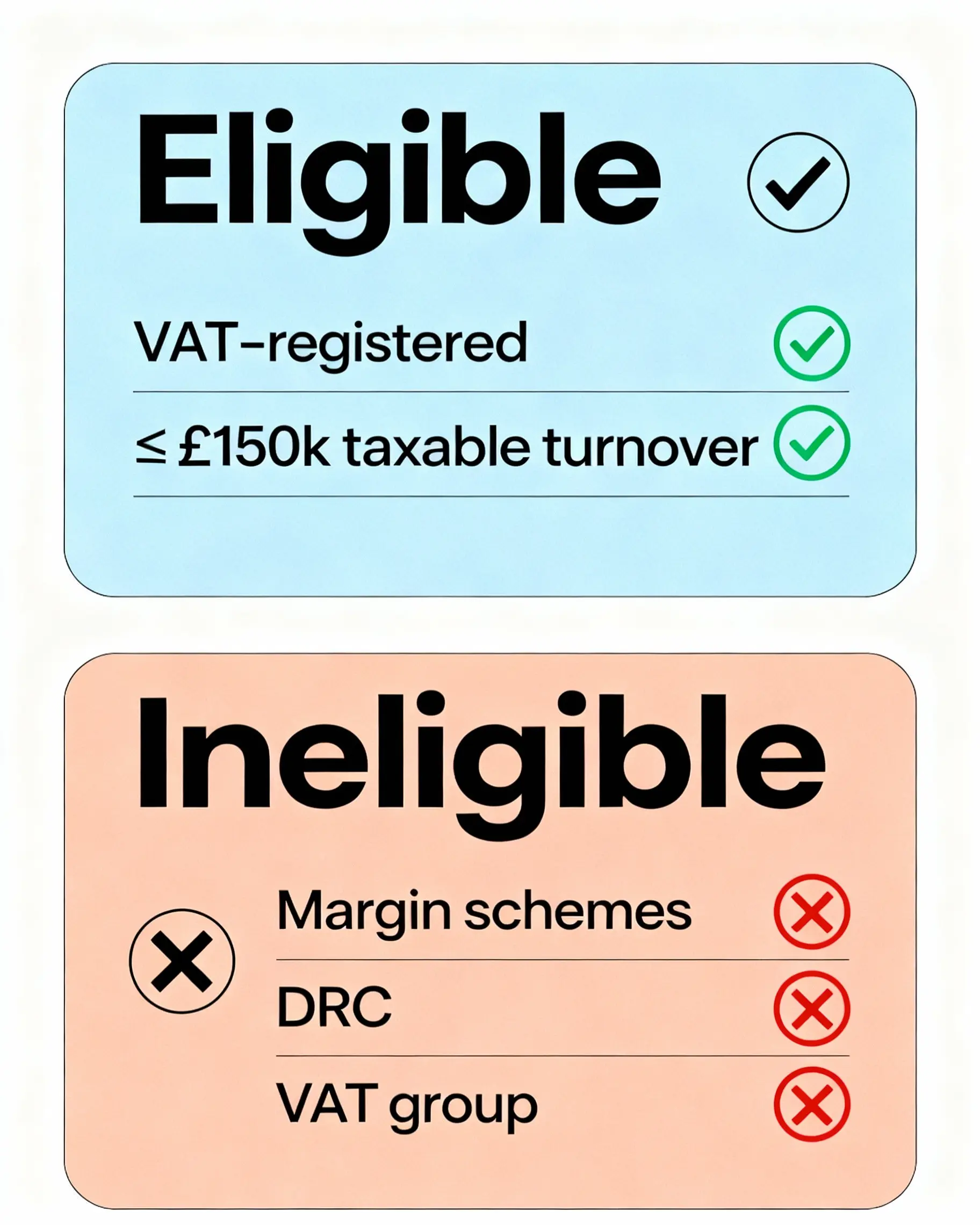

Who Can Join (and Who Cannot)?

The VAT Flat Rate Scheme is designed for small, independent UK businesses that want a simpler way to handle VAT. Before joining, it's important to know who qualifies — and who doesn't. Many readers also check How Much Is VAT in the UK to understand the standard rate before deciding if the scheme fits their numbers.

Eligibility

You can apply for the Flat Rate Scheme if:

- Your business is VAT-registered in the UK.

- You expect your VAT-taxable turnover (excluding VAT) to be £150,000 or less over the next 12 months.

- You're not closely associated with another company — for example, through shared control, ownership, or as part of a VAT group or division.

This scheme is ideal for freelancers, consultants, and small firms with straightforward transactions and low goods spending.

Ineligible Cases

You cannot use the Flat Rate Scheme if:

- ✗You've left the scheme within the last 12 months.

- ✗You've been convicted of a VAT offence or penalised for VAT evasion within the last 12 months (routine late filing alone doesn't bar entry).

- ✗You use or plan to use any margin schemes (for example, second-hand goods or auctioneers).

- ✗You're part of the Capital Goods Scheme, a VAT group, or a business division.

- ✗You make domestic reverse charge supplies (such as in construction).

- ✗You fall under the Tour Operator's Margin Scheme (TOMS).

Pick Your Flat Rate (by Business Type)

Every business type in the UK has a specific flat rate percentage set by HMRC under the VAT Flat Rate Scheme. You choose the sector that best describes your main activity — the one that earns you the most turnover. The percentage you apply depends on that choice.

Below are some common UK business sectors and their current flat rate percentages:

| Type of business | VAT flat rate (%) |

|---|---|

| Accountancy or bookkeeping | 14.5% |

| Advertising | 11% |

| Agricultural services | 11% |

| Any other activity not listed elsewhere | 12% |

| Architect, civil and structural engineer or surveyor | 14.5% |

| Boarding or care of animals | 12% |

| Business services not listed elsewhere | 12% |

| Catering services incl. restaurants and takeaways before 15 Jul 2020 | 12.5% |

| Catering services 15 Jul 2020 – 30 Sep 2021 | 4.5% |

| Catering services 1 Oct 2021 – 31 Mar 2022 | 8.5% |

| Catering services from 1 Apr 2022 | 12.5% |

| Computer and IT consultancy or data processing | 14.5% |

| Computer repair services | 10.5% |

| Entertainment or journalism | 12.5% |

| Estate agency or property management services | 12% |

| Farming or agriculture not listed elsewhere | 6.5% |

| Film, radio, television, or video production | 13% |

| Financial services | 13.5% |

| Forestry or fishing | 10.5% |

| General building or construction services* | 9.5% |

| Hairdressing or other beauty treatment services | 13% |

| Hiring or renting goods | 9.5% |

| Hotel or accommodation before 15 Jul 2020 | 10.5% |

| Hotel or accommodation 15 Jul 2020 – 30 Sep 2021 | 0% |

| Hotel or accommodation 1 Oct 2021 – 31 Mar 2022 | 5.5% |

| Hotel or accommodation from 1 Apr 2022 | 10.5% |

| Investigation or security | 12% |

| Labour-only building or construction services* | 14.5% |

| Laundry or dry-cleaning services | 12% |

| Lawyer or legal services | 14.5% |

| Library, archive, museum, or other cultural activity | 9.5% |

| Management consultancy | 14% |

| Manufacturing fabricated metal products | 10.5% |

| Manufacturing food | 9% |

| Manufacturing not listed elsewhere | 9.5% |

| Manufacturing yarn, textiles, or clothing | 9% |

| Membership organisation | 8% |

| Mining or quarrying | 10% |

| Packaging | 9% |

| Photography | 11% |

| Post offices | 5% |

| Printing | 8.5% |

| Publishing | 11% |

| Pubs before 15 Jul 2020 | 6.5% |

| Pubs 15 Jul 2020 – 30 Sep 2021 | 1% |

| Pubs 1 Oct 2021 – 31 Mar 2022 | 4% |

| Pubs from 1 Apr 2022 | 6.5% |

| Real estate activity not listed elsewhere | 14% |

| Repairing personal or household goods | 10% |

| Repairing vehicles | 8.5% |

| Retailing food, confectionery, tobacco, newspapers, or children's clothing | 4% |

| Retailing pharmaceuticals, medical goods, cosmetics, or toiletries | 8% |

| Retailing not listed elsewhere | 7.5% |

| Retailing vehicles or fuel | 6.5% |

| Secretarial services | 13% |

| Social work | 11% |

| Sport or recreation | 8.5% |

| Transport or storage, incl. couriers, freight, removals, and taxis | 10% |

| Travel agency | 10.5% |

| Veterinary medicine | 11% |

| Wholesaling agricultural products | 8% |

| Wholesaling food | 7.5% |

| Wholesaling not listed elsewhere | 8.5% |

* Footnote:

- • "Labour-only building or construction" means materials are under 10% of turnover for those services.

- • Over 10% moves you into General building or construction.

Source: HMRC VAT Flat Rate Scheme guidance (VAT Notice 733, updated 14 April 2026). Based on our findings at vatukcalculator.com, always match your expected activity for the next 12 months, not past work.

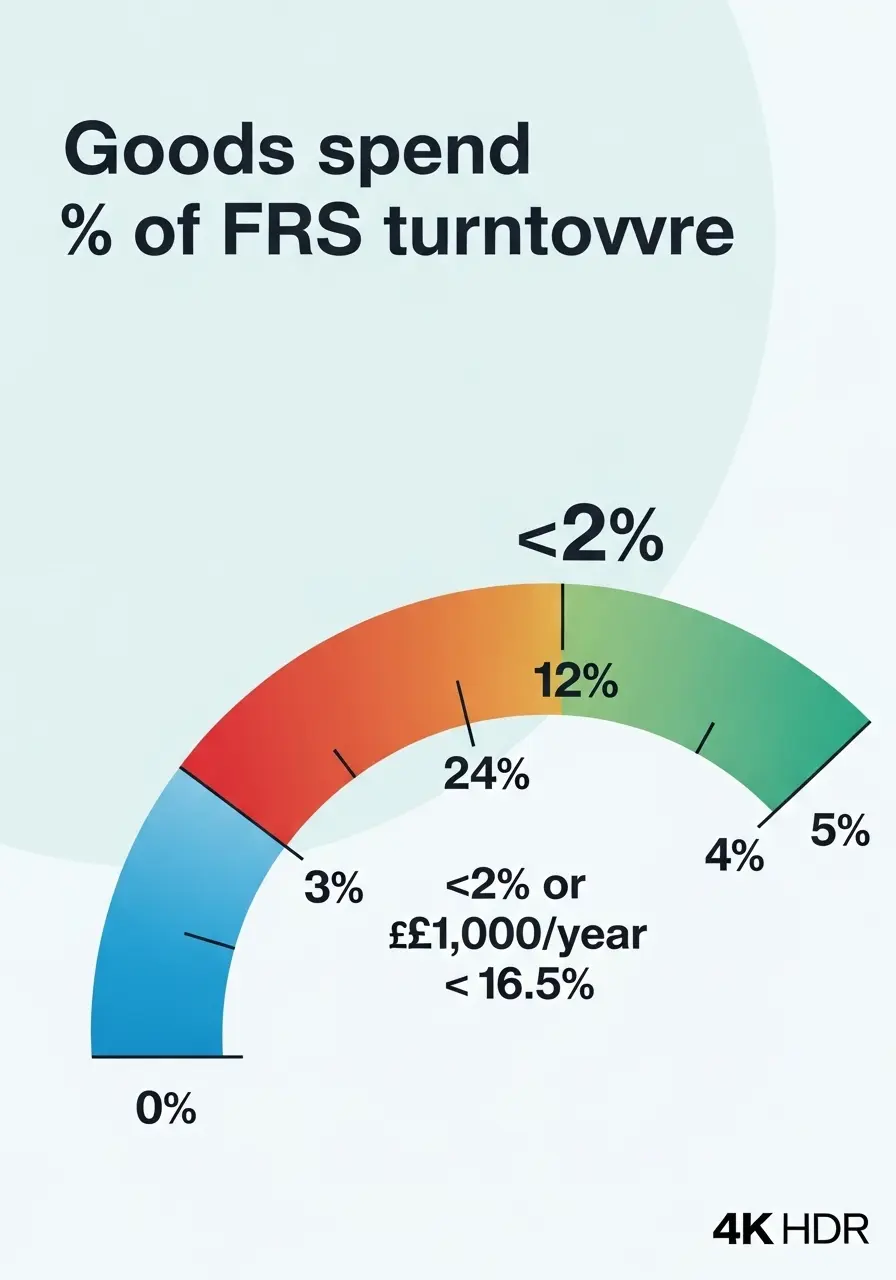

Limited-Cost Trader (The 16.5% Rule)

If your business spends very little on goods, you may fall under the limited-cost trader category. This rule prevents service-heavy companies from benefiting unfairly from lower flat rates.

The Test (Run Each VAT Return)

You're classed as a limited-cost trader if:

- •Your spend on relevant goods is less than 2% of your VAT Flat Rate Scheme turnover, or

- •It's more than 2%, but under £1,000 per year (pro-rated for shorter accounting periods).

If this applies, you must use a flat rate of 16.5%, no matter which sector your business belongs to. Our analysis at vatukcalculator.com shows that this rule mainly affects consultants, designers, and digital service providers who buy a few physical goods.

💡 Example

If your VAT-inclusive turnover is £50,000 and you spent only £800 on relevant goods, that's 1.6% — so you'll pay 16.5% flat rate on your turnover.

What Counts as Relevant Goods

Only tangible items used directly in your business qualify. Examples include:

- Stationery and office supplies

- Cleaning products for your workspace

- Stock or resale items

- Standard packaged software on a physical disk

- Fuel used in taxis or delivery vehicles you own or lease

- Packaging materials

- Food ingredients used in customer meals (for catering businesses)

What Does Not Count

Many common expenses do not qualify as relevant goods. These include:

- ✗Services such as accountancy, advertising, or rent

- ✗Downloaded or bespoke software

- ✗Food or drinks for you or your staff

- ✗Vehicles, vehicle parts, or fuel, unless you're in transport using your own or leased vehicle

- ✗Capital expenditure goods (e.g., equipment over £2,000)

- ✗Items bought only to pass the 2% test

- ✗Postage and stamps

Summary:

If your spending on physical goods is minimal, HMRC treats you as a low-cost trader and applies a fixed rate of 16.5%. It maintains fairness between service-based and product-based businesses.

For easy checks, try the Limited-Cost Test Tool on vatukcalculator.com before filing your return.

Work Out Your Flat Rate (With Worked Examples)

The VAT Flat Rate Scheme is simple once you know your rate. You only need two things — your VAT-inclusive turnover and your flat rate percentage.

Formula

VAT due = VAT-inclusive turnover × your flat rate

Your VAT-inclusive turnover means the total you billed, including VAT. For example, if you charged £1,000 plus 20% VAT, your VAT-inclusive turnover is £1,200.

Under the standard VAT method, you'd normally calculate VAT on sales minus VAT on purchases. If you need to understand basic VAT calculations first, you can use our standard VAT calculator. But under the Flat Rate Scheme, you skip all that. You just apply your fixed rate to your total turnover.

Example A — Photographer (11%)

If your total VAT-inclusive sales are £1,200, and your flat rate is 11%, your VAT due is:

£1,200 × 11% = £132

So, you'll pay £132 to HMRC instead of calculating input and output VAT separately.

Example B — Caterer (12.5%)

A catering business with the same £1,200 turnover pays:

£1,200 × 12.5% = £150

That's your total VAT payment for the period — quick, consistent, and error-free.

Split Periods — When Your Rate Changes Mid-Period

If your business rate changes (for example, temporary government relief or sector update), you must split your return into two periods and apply the correct rate to each part.

Example: If you charged £10,000 before and £5,000 after a rate change, calculate each separately using the rate valid at that time.

First-Year 1% Discount

HMRC rewards new VAT-registered businesses with a 1% discount on their flat rate during the first 12 months of registration.

Quick Examples

| Business Type | Normal Rate | Discounted Rate (1st Year) | VAT-Inclusive Turnover | VAT Due |

|---|---|---|---|---|

| IT Consultancy | 14.5% | 13.5% | £50,000 | £6,750 |

| Catering | 12.5% | 11.5% | £30,000 | £3,450 |

| Retailing Food | 4% | 3% | £40,000 | £1,200 |

| Photographer | 11% | 10% | £25,000 | £2,500 |

| Transport/Storage | 10% | 9% | £35,000 | £3,150 |

Our analysis at vatukcalculator.com shows that this discount can save up to £500–£800 in your first year, depending on your turnover and business type.

Summary:

Under the VAT Flat Rate Scheme, your VAT due is a simple percentage of your total VAT-inclusive turnover. Apply your flat rate, adjust for any 1% first-year discount, and keep a note if your rate changes mid-period. This approach keeps calculations straightforward and reduces the time spent managing VAT records.

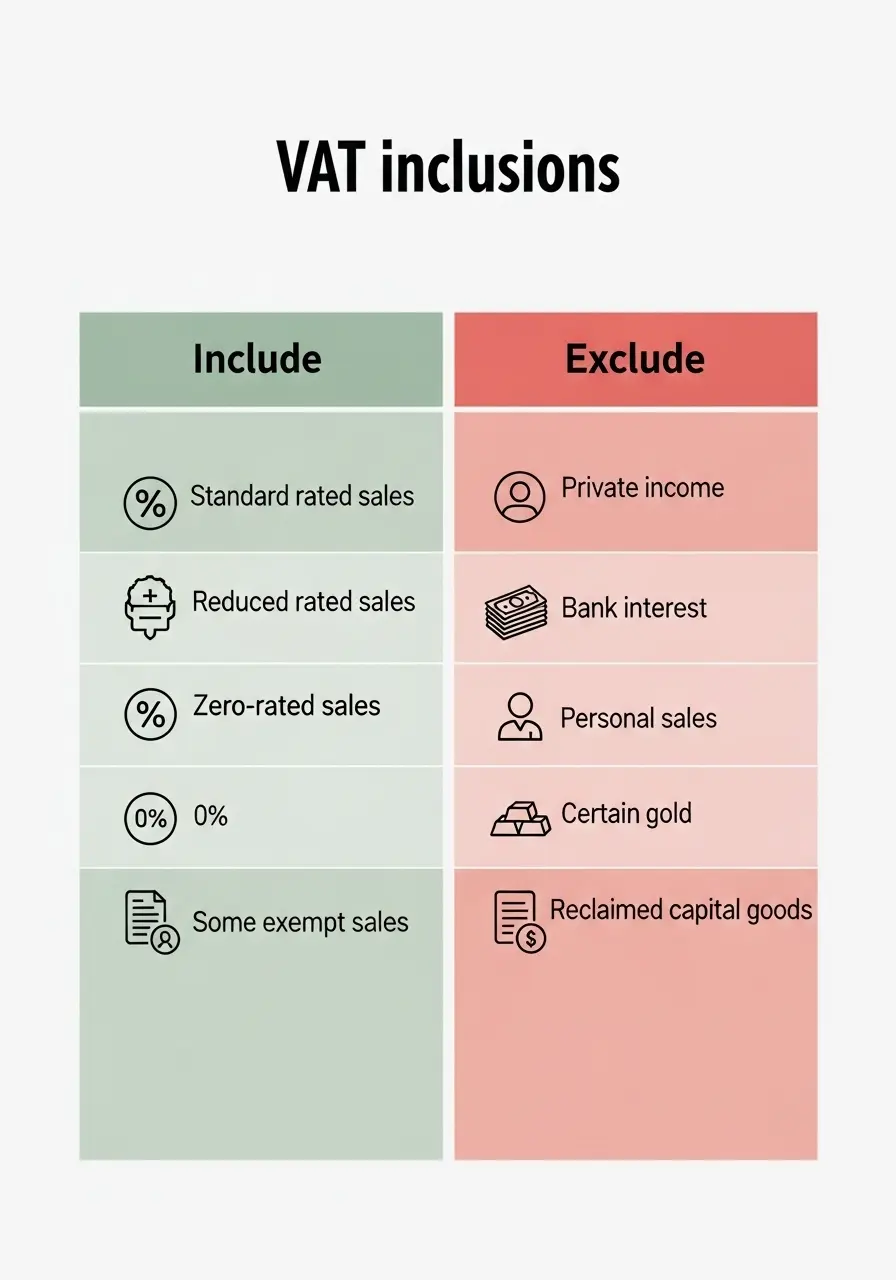

VAT-Inclusive Turnover — What to Include or Exclude in the VAT Flat Rate Scheme

Your VAT-inclusive turnover is the total of everything you sell that falls under VAT, including VAT itself. It's what you use to work out your flat rate payment to HMRC. Getting this figure right is crucial — missing or adding the wrong items can lead to penalties or overpayment.

What to Include

You should include all taxable business income in your VAT-inclusive turnover under the VAT Flat Rate Scheme. This covers:

- Standard-rated sales – most goods and services are charged at 20%.

- Reduced-rate sales – like domestic fuel or power at 5%.

- Zero-rated sales – items such as children's clothing, books, and newspapers.

- Some exempt income, like rent or lottery commission, if it forms part of your business activity.

- Sales of capital goods, unless they're handled outside the Flat Rate Scheme (for example, when you've already reclaimed input VAT on them).

💡 Example

If a design agency bills £12,000 in a quarter (including VAT) — £10,000 standard-rated work, £1,000 zero-rated items, and £1,000 rent — then £12,000 counts toward FRS turnover.

What to Exclude

Do not include income or transactions that aren't part of your VAT business. Exclude:

- ✗Private income or money unrelated to business activity.

- ✗Bank interest, dividends, or other financial income.

- ✗Non-business supplies (e.g., selling personal items).

- ✗Sales of capital goods, if you reclaimed input VAT when buying them.

- ✗Certain gold supplies are covered by special accounting rules.

💡 Our analysis shows that small traders often overpay because they mistakenly include bank interest or private transfers — check these carefully before filing.

Special Circumstances

Some cases need extra attention:

Reverse charge services (from outside the UK):

These are outside the Flat Rate Scheme, but you must still record the values in Box 1 and Box 4 of your VAT return.

Northern Ireland ↔ EU rules:

For distance sales or cross-border services, include only UK-taxable supplies; exclude exports where VAT is accounted for in the other country.

Postponed VAT accounting (imports):

Since June 2022, exclude the import value from your FRS turnover. Instead, report the import VAT in Box 1 after completing your flat rate calculation.

💬 According to Mirza Shafique at vatukcalculator.com, many small firms miss this step when switching to postponed VAT accounting under the VAT Flat Rate Scheme, which can distort FRS payments.

Summary:

Your VAT-inclusive turnover includes all taxable UK sales (even zero-rated ones) but excludes private or non-business income. Watch for special cases like imports and reverse charge services — getting these right keeps your VAT return compliant and accurate.

How FRS Compares to Other VAT Schemes

Below is a quick side-by-side view. It shows where each scheme fits best and what to watch.

| Feature | Flat Rate Scheme (FRS) | Standard VAT | Cash Accounting | Annual Accounting |

|---|---|---|---|---|

| Admin time | Low. One % on VAT-inclusive turnover. | Higher. Track input and output VAT. | Medium. Track payments received/paid. | Low–medium. One return a year. |

| Input VAT reclaim | No, except a single capital goods buy ≥ £2,000 (incl. VAT). | Yes. Claim all allowable input VAT. | Yes. Claim when you pay suppliers. | Yes. Normal rules apply. |

| Cash flow | Predictable. % of gross sales. | Varies with costs and timing. | Helps if clients pay late. VAT due on receipt. | Predictable instalments through the year. |

| Best for services/goods | Service-heavy firms with low goods spend. | Firms with regular VAT on purchases. | Firms with slow-paying customers. | Stable businesses that prefer fewer filings. |

| Refund patterns | Refunds are rare. Limited reclaim options. | Refunds are common if costs exceed sales VAT. | Similar to Standard, but on a cash basis. | Refund only on the annual return. |

| Eligibility limits | Join if the next 12-month taxable turnover ≤ £150k (ex VAT). Leave if income > £230k (incl. VAT). | No turnover limit. | Join if taxable turnover ≤ £1.35m. | Join if taxable turnover ≤ £1.35m. |

| Limited-cost rule | Use 16.5% if relevant goods < 2% or < £1,000 p.a. | Not applicable. | Not applicable. | Not applicable. |

| Works with other schemes | Not with Cash Accounting or Retail Schemes. Has its own cash/retail methods. | Can pair with Cash/Annual if eligible. | Annual Accounting can be combined with FRS — a common pairing for simpler reporting. | Can combine with FRS — apply using VAT600AA. |

| Sector rates | Yes. Fixed % by sector. | No. Use standard VAT rules. | No. Use standard VAT rules. | No. Use standard VAT rules. |

| Switching friction | Moderate. Must notify and track anniversary checks. | Low. It's the default method. | Moderate. Must meet limits and rules. | Moderate. Instalments and timing rules. |

Our analysis shows:

- •Pick FRS if your goods spend is light and you value speed.

- •Pick Standard if you reclaim a lot of input VAT.

- •Pick Cash Accounting if late customer payments hit you often.

- •Pick Annual Accounting if you prefer one return and steady installments.

Case Studies — Realistic VAT Scenarios

Real-world examples help show when the VAT Flat Rate Scheme (FRS) saves money and when it doesn't. Each case uses real figures from our analysis at vatukcalculator.com to make comparisons clear.

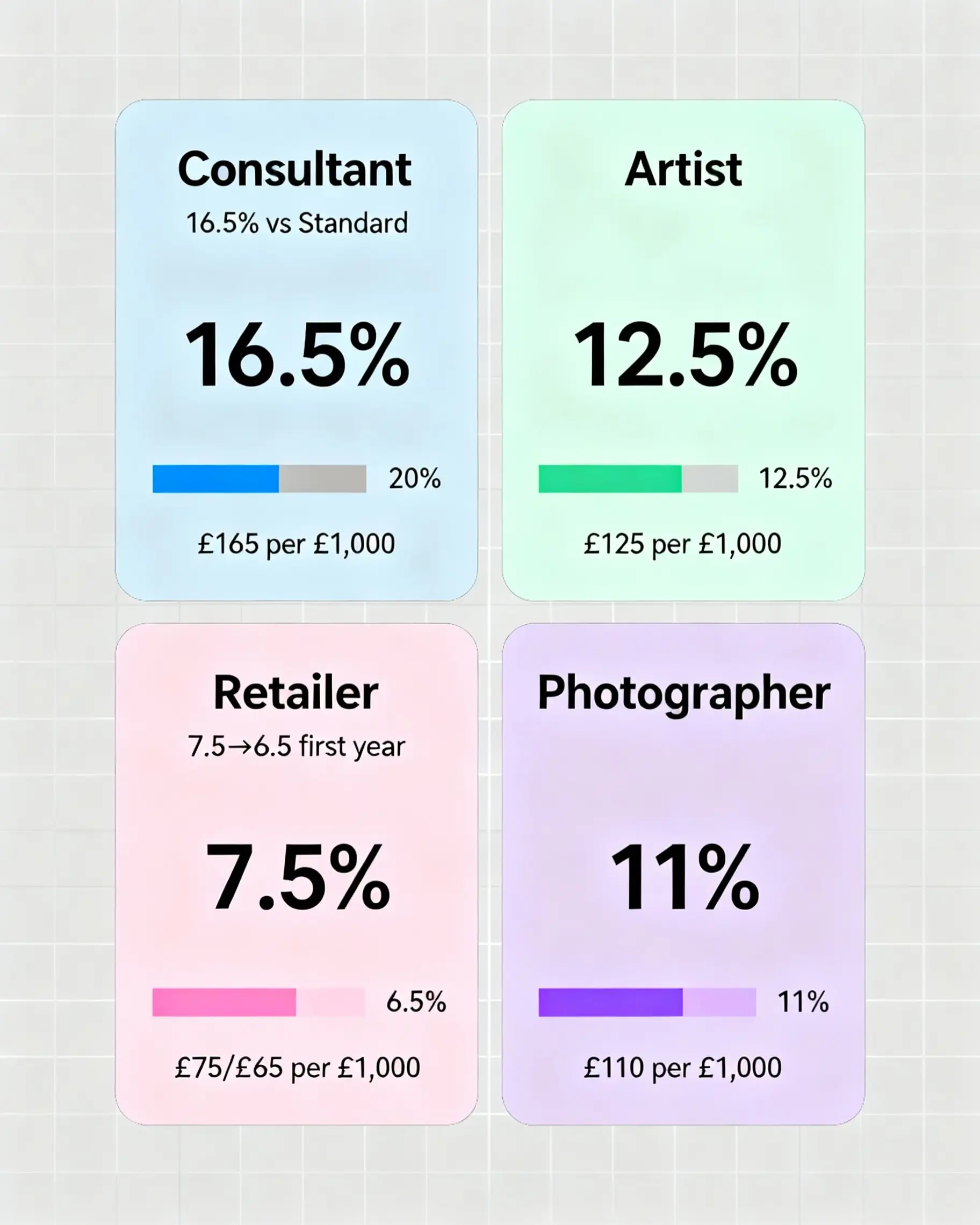

Case 1: Consultant (Limited-Cost Trader @16.5%) vs Standard VAT

Turnover: £31,320 (VAT inclusive)

FRS rate: 16.5%

Flat Rate VAT due:

£31,320 × 16.5% = £5,167.80

Under the Standard VAT scheme:

The same consultant bills £26,100 + £5,220 VAT and reclaims £293 VAT on expenses.

£5,220 – £293 = £4,927 VAT due

Result:

The consultant pays £240.80 more under FRS.

When your goods spending is very low, the Limited-Cost Trader rule increases your rate and often wipes out any financial benefit.

👉 Run your figure in the calculator to see your own comparison.

Case 2: Artist (12.5% Sector, Not Limited-Cost)

Turnover: £31,320 (VAT inclusive)

FRS rate: 12.5%

Flat Rate VAT due:

£31,320 × 12.5% = £3,915

Under the Standard VAT scheme:

The artist's raw materials add £1,200 + £240 VAT to their expenses.

Standard VAT due = £5,220 – £240 = £4,980

Result:

The artist saves £1,065 under the Flat Rate Scheme.

Because their spending is above 2%, they avoid the Limited-Cost rule and benefit from the simplified system.

👉 Run your figure in the calculator to check your savings.

Case 3: Retailer (7.5%) — First-Year Discount Example

Turnover: £60,000 (VAT inclusive)

Normal rate: 7.5% → Discounted first-year rate: 6.5%

Flat Rate VAT due:

£60,000 × 6.5% = £3,900

Under the Standard Scheme:

A similar retailer with modest purchases worth £4,000 + £800 VAT would owe:

£10,000 (output VAT) – £800 (input VAT) = £9,200, spread over the same period.

Result:

Savings of over £5,000 in the first year.

Actual savings vary — most retailers have higher input VAT on stock, which narrows the gap. Run your own figures in the calculator for accuracy.

👉 Run your figure in the calculator to confirm your benefit.

Case 4: Photographer (11%) — Quick Scenario

Turnover: £24,000 (VAT inclusive)

Flat Rate VAT due: £24,000 × 11% = £2,640

A photographer under the Standard Scheme with about £600 in input VAT would pay £4,000 – £600 = £3,400 VAT due.

Result:

They save £760 with the Flat Rate Scheme, plus time spent tracking invoices and receipts.

👉 Run your figure in the calculator and compare your own VAT liability.

Summary:

The VAT Flat Rate Scheme (FRS) suits service-based or creative businesses with low goods spending. Limited-cost traders often pay more, but others save significantly — especially in their first year or if their input VAT is minimal. Always check your rate with the calculator before choosing your scheme.

Capital Expenditure Goods — When You Can Reclaim

Under the Flat Rate Scheme, most input VAT can't be reclaimed. But there's one key exception: you can reclaim VAT on a single purchase of capital goods worth £2,000 or more (including VAT).

This rule helps businesses that buy long-term equipment like vans, computers, or professional tools — items used to generate income over time, not everyday consumables.

What Qualifies as a "Single Purchase"

A single purchase means one invoice or transaction where the total cost (including VAT) is £2,000 or more. Even if the invoice includes several related items, it still counts as one purchase if bought together.

✅ Examples:

- • A complete computer setup (laptop, printer, and monitor) on one receipt totalling £2,100.

- • Kitchen equipment for a café — oven, fridge, and dishwasher bought together from the same supplier.

❌ Not eligible:

- • Items bought separately from different suppliers or at different times.

- • Combined items below £2,000 each on separate invoices.

Goods vs Services — Key Difference

Only capital goods qualify, not services. For instance:

Service (no reclaim allowed):

- • Building an office extension

- • Hiring or leasing a van

Goods (reclaim allowed):

- • Buying a delivery van

- • Purchasing equipment

If you're unsure whether your purchase counts as goods or services, check the description on the supplier's VAT invoice or consult your accountant.

Sale or Disposal Later

When you sell or trade in a capital asset you claimed VAT on, you must charge output VAT on the sale price — at the normal VAT rate, not your flat rate.

💡 Example

A business buys a delivery van for £6,000 (including £1,000 VAT) and reclaims that VAT.

Later, it sells the van for £2,000.

It must pay 20% VAT on the £2,000, not apply its flat rate percentage.

Quick Summary

- •You can reclaim VAT on capital goods costing £2,000 or more (including VAT).

- •Must be a single invoice purchase, not multiple small ones.

- •Applies only to goods, not services.

- •When selling, charge normal VAT on disposal.

According to Mirza Shafique at vatukcalculator.com, most small businesses miss this reclaim opportunity because they treat capital purchases like routine expenses. Checking your invoices can easily save hundreds in lost VAT credits.

Record-Keeping, Invoices, and VAT Returns

Running your business under the VAT Flat Rate Scheme (FRS) is simpler, but it still needs solid record-keeping. HMRC expects you to keep clear and accurate records that show how your VAT was calculated and what rate you used.

What You Must Record

Keep a running record of:

- Your total VAT-inclusive turnover for each VAT period.

- The flat rate percentage you used.

- The VAT you paid to HMRC.

- You spend on relevant goods for the limited-cost test.

- Any capital goods purchases of £2,000 or more (for reclaim).

These details help if HMRC reviews your returns. Records should be kept for at least six years, either digitally or on paper.

Invoicing Rules

Even under the FRS, you must issue VAT invoices in the standard format when selling to VAT-registered customers. Each invoice must include:

• Your business name and VAT number

• The VAT rate charged (normally 20%)

• The gross total including VAT

• A clear description of goods or services sold

Customers can still reclaim input VAT from your invoice if they're VAT-registered — even though you'll pay HMRC using your flat rate.

VAT Return Methods

There are three main return methods under the FRS:

Basic method

Most common; you calculate VAT due using your VAT-inclusive turnover.

Cash-based method

Use when you pay VAT only after customers pay you.

Retailer's turnover method

Used by retailers with many small daily sales; VAT is based on daily takings.

Choose the method that best fits your business model. For example, cash-based accounting helps with cash flow if clients pay late.

Common Mistakes to Avoid

Many businesses make simple VAT return errors that can trigger HMRC penalties. Here are the most frequent ones:

- ⚠️Forgetting to include exempt income in turnover.

- ⚠️Entering net sales in Box 6 instead of VAT-inclusive totals.

- ⚠️Claiming the 1% first-year discount after 12 months have passed.

- ⚠️Entering amounts in Box 4 ("input VAT") — it should be zero unless reclaiming for capital goods.

- ⚠️Missing Northern Ireland acquisitions VAT in mixed UK-EU trade cases.

Summary

The VAT Flat Rate Scheme reduces admin, but your VAT records still need accuracy. Keep every calculation, invoice, and return clear and accessible — this protects you during audits and ensures your figures stay consistent.

According to Mirza Shafique at vatukcalculator.com, around 20% of FRS users misreport their turnover boxes on VAT returns, mostly due to confusion over VAT-inclusive figures. Double-checking each entry before submission can save both time and penalties.

Bad Debt Relief (under the VAT Flat Rate Scheme)

Sometimes, a customer doesn't pay their invoice — even after months of reminders. The Bad Debt Relief (BDR) rules allow you to recover some of the VAT you already paid to HMRC on that unpaid sale.

Under the Flat Rate Scheme (FRS), the way you claim depends on which accounting method you use.

For Basic or Retailer's Turnover Methods

If you use either of these methods, you can claim bad debt relief at the standard VAT rate (usually 20%) — not your flat rate. That's because your FRS percentage already includes an allowance for input VAT only if you've been paid. When you're not paid, you never received that allowance, so HMRC lets you reclaim the VAT in full.

Example

You issued an invoice for £1,200 (including £200 VAT), but your client never paid.

You can reclaim the £200 VAT in your next VAT return using standard bad debt relief rules.

For the Cash-Based Method

If you use the cash turnover method, your VAT is only due when you actually receive payment. But if the invoice stays unpaid for six months, and you've already accounted for VAT, you can claim relief for the difference between:

- 1.The VAT is charged to the customer.

- 2.The amount you would've paid under FRS if they had paid.

Simple 3-Step Example:

1. VAT shown on invoice: £200

2. VAT due under your flat rate (say 10% of £1,200): £120

3. Difference = £200 - £120 = £80 → claim £80 as bad debt relief.

This figure goes into your VAT account (Box 4) in your next return. It either reduces what you owe or increases your refund.

Quick Summary

- •Wait at least 6 months after the due date.

- •Write off the debt in your accounts.

- •Claim relief in your next VAT return.

Our analysis shows that many small businesses forget to apply for bad debt relief under FRS, losing easy savings. According to vatukcalculator.com, even a few small claims each year can improve cash flow for service-based firms using the flat rate method.

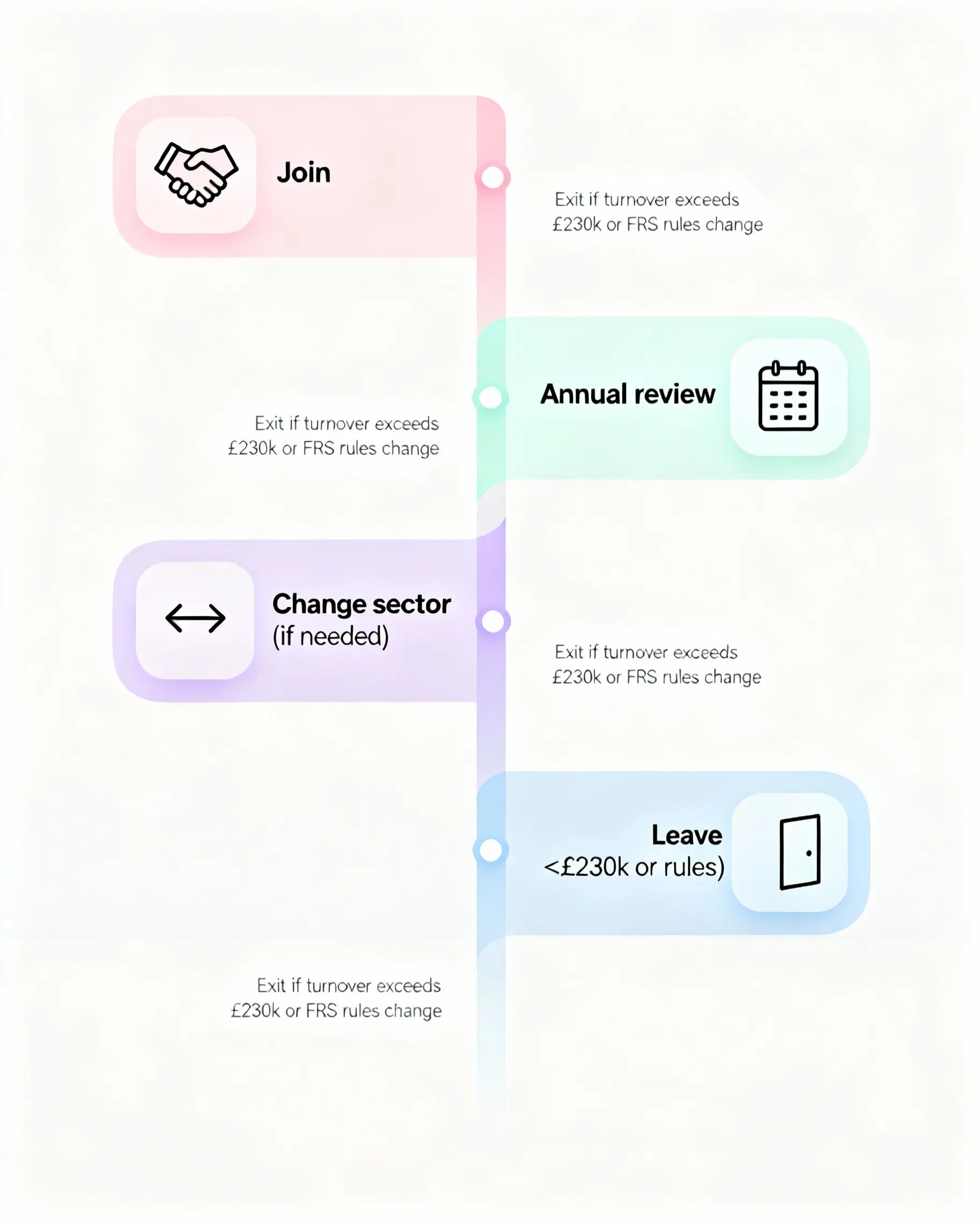

Joining, Changing, and Leaving the VAT Flat Rate Scheme

Joining or leaving the Flat Rate Scheme (FRS) isn't complicated, but you must follow HMRC's timing and reporting rules carefully. Here's how to manage every stage — from applying to leaving and rejoining.

How to Apply

You can join the scheme when you first register for VAT or later, once you're already VAT-registered. To apply:

- Complete Form VAT600FRS online or send it by email or post.

- You'll need to provide your expected VAT-taxable turnover and chosen business sector.

- HMRC usually confirms your approval in writing.

If you prefer fewer filings, you can also apply for the Annual Accounting Scheme using Form VAT600AA, which combines both systems for simpler reporting.

Tip: According to Mirza Shafique at vatukcalculator.com, applying online is the fastest route, and most approvals are processed within 3–5 working days.

Changing Sector or Activity

If your business activity changes — for example, you move from freelance design to management consultancy — you may need to switch your flat rate category.

- •Review your chosen sector rate each anniversary of joining.

- •If your new activity fits another category, notify HMRC within 30 days of the change.

- •Keep written records explaining why you switched sectors; this helps if HMRC reviews your rates later.

Our analysis shows that many traders forget this review step, which can lead to overpaying VAT if their rate is higher than necessary.

When You Must Leave

You must leave the Flat Rate Scheme if:

- ✗Your total income (including VAT) for the last 12 months exceeds £230,000.

- ✗You expect to exceed £230,000 in the next 30 days (forward-looking test).

- ✗You start using the Tour Operator's Margin Scheme (TOMS) or the Capital Goods Scheme.

- ✗You join or become eligible for a VAT group or division.

- ✗Your business becomes closely associated with another company.

Once you leave, you can't rejoin for 12 months.

Example

If your turnover hits £240,000 in May, you must leave the FRS by the start of June, even if you expect income to drop later.

After Leaving

When leaving, you'll complete one last VAT return under FRS. For that period, calculate VAT in two parts:

Up to the leaving date:

Use your flat rate.

After leaving date:

Use the standard VAT method (input vs output).

If you still hold stock or capital assets, you may reclaim extra input VAT if they were purchased while you used FRS.

Example

If you leave on 1 April and have £3,000 worth of stock (including £500 VAT), you can add the £500 to your input VAT in your next standard VAT return.

Summary

Joining and leaving the Flat Rate Scheme requires timely action and clear records. Apply using VAT600FRS when eligible. Review your sector rate annually. Leave if turnover exceeds the threshold or business activity changes significantly. Following these steps ensures compliance and maintains clean, transparent VAT reporting — a must for any growing UK business.

Penalties and Timings

Even though the Flat Rate Scheme (FRS) simplifies VAT, HMRC still applies strict penalties for late returns or payments. Staying organised helps you avoid fines and maintain compliance.

Late Submission Penalties

Since 1 January 2023, HMRC has used a penalty points system for late VAT returns. Here's how it works:

| Number of Late Returns | Penalty Points | Action Taken |

|---|---|---|

| 1 | 1 point | Warning only |

| 2–3 | 2–3 points | Continue building up points |

| 4 | Reaches threshold (for quarterly filers) | £200 penalty |

| Every late return after the threshold | +£200 each time | Ongoing £200 penalties |

You can clear your penalty points by submitting all VAT returns on time for 12 months.

Example

If your business files quarterly and you miss four returns, you'll pay £200, and each late return after that adds another £200 fine.

Late Payment Penalties

If you pay your VAT late, HMRC adds both penalties and interest:

First 15 days overdue:

No charge if paid or agreed for a Time-to-Pay (TTP) plan.

Day 16–30:

2% penalty on the amount still owed.

After 30 days:

Another 2% penalty plus daily interest (currently Bank of England base rate + 2.5%).

If you're struggling with cash flow, contact HMRC early to agree on a Time-to-Pay arrangement — it pauses penalties once approved.

Filing and Payment Checklist

| Task | Frequency | Due Date |

|---|---|---|

| VAT Return submission | Quarterly or annually | 1 month + 7 days after period end |

| VAT Payment | Same date as submission | Use Direct Debit or the HMRC portal |

| Flat rate review | Annually | On the scheme anniversary |

| Limited-cost test | Each VAT period | Before submitting the return |

Example

If your VAT quarter ends on 30 June, your return and payment are both due by 7 August.

Summary

- •File and pay on time — delays quickly lead to £200+ penalties.

- •Always review your FRS rate and limited-cost status before submitting.

- •Use Direct Debit or reminders to stay compliant.

According to vatukcalculator.com, nearly 1 in 6 small businesses miss at least one VAT deadline per year, usually from poor record-keeping rather than lack of funds. Setting up automatic reminders can prevent these avoidable fines.

Special Sectors and Notes

Some sectors using the Flat Rate Scheme (FRS) have unique rules. HMRC requires extra care in record-keeping and VAT treatment, especially where shared costs or international transactions are involved.

Barristers and Chambers

Barristers who work within chambers often share common expenses, such as rent, utilities, or clerking services. When operating under the Flat Rate Scheme, they must:

- •Keep clear records showing the original VAT invoice value and how input VAT is split among members.

- •Record the percentage of VAT reclaimed for each invoice and how it's apportioned.

- •Make these records available to HMRC officers during compliance visits.

If the chambers use method 3 (where a nominated member handles VAT for the group), each barrister must ensure that no input VAT is claimed on their behalf incorrectly. This prevents double claims and keeps their FRS calculations accurate.

Our analysis shows that HMRC often focuses on barristers' shared expense tracking during audits — missing or unclear records can result in penalties or back-dated tax adjustments.

Northern Ireland and EU Movements

If your business is based in Northern Ireland (NI) and trades with the EU, special VAT rules apply:

Goods moved between NI and the EU:

Still treated as intra-EU transactions.

Services:

Follow the "place of supply" rule — most are taxed where the customer is based.

Record these transactions:

Outside the Flat Rate Scheme, but still include them in Box 1 and Box 4 of your VAT return when required.

Businesses dealing with imports should also note the postponed VAT accounting rule: imported goods are excluded from FRS calculations, and the import VAT is recorded separately.

Domestic Reverse Charge Sectors

Businesses in industries affected by the Domestic Reverse Charge (DRC) — such as construction, telecoms, and certain energy trades — cannot use the Flat Rate Scheme for those specific supplies.

Important Notes:

- ⚠️You cannot include DRC supplies within your FRS calculation, but you may still use FRS for other eligible sales.

- ⚠️Account for DRC items outside the scheme. Do not include DRC supplies in your FRS percentage calculation or Box 6 VAT-inclusive turnover.

- ⚠️Under DRC, the customer, not the supplier, accounts for VAT directly to HMRC.

That means those transactions are outside FRS, even if the rest of your business uses it. You'll still include these supplies in turnover records but exclude them from your FRS percentage calculation.

According to vatukcalculator.com, this rule often catches out small builders and subcontractors who assume all invoices can follow one method — but DRC and FRS can't run together on the same transaction type.

Summary

- • Barristers must maintain detailed shared-cost VAT records.

- • NI/EU traders handle cross-border goods and services separately from FRS.

- • DRC-sector businesses can't apply FRS to reverse-charge supplies.

Keeping these exceptions in check helps your business avoid compliance errors and unwanted HMRC scrutiny.

International Variants

While the UK Flat Rate Scheme (FRS) is unique to HMRC, some countries operate similar systems under different names.

Ghana VAT Flat Rate Scheme (VFRS)

For example, the Ghana VAT Flat Rate Scheme (VFRS) is designed for retailers who sell taxable goods. Under this system, businesses with annual turnover between GHC 200,000 and GHC 500,000 charge a fixed 3–4% rate on total sales. The goal is to simplify VAT reporting, reduce paperwork, and help smaller traders stay compliant without detailed input-output tracking.

Key Differences from UK FRS:

- •The Ghanaian VFRS applies to goods only, not services

- •Uses different thresholds (GHC 200,000 - 500,000)

- •Fixed 3–4% rate vs UK's sector-specific rates

- •Different scope and rate structure reflecting Ghana's tax policy

However, the Ghanaian VFRS is not the same as the UK FRS — it applies to goods only, not services, and uses different thresholds and rates. Each country's system reflects its own tax policy, government structure, and economic conditions.

Our analysis shows:

These simplified VAT systems share a common purpose: to ease compliance for small businesses while ensuring steady tax revenue collection.

Summary:

- •Ghana's VFRS focuses on retail sales with a flat 3–4% tax.

- •It simplifies tax compliance but differs from the UK FRS in scope and rate structure.

- •Always confirm which national VAT system applies before calculating tax on international sales.

FAQs — VAT Flat Rate Scheme (UK 2026)

1. What is VAT-inclusive turnover under FRS?

VAT-inclusive turnover means your total sales, including VAT. It covers all standard, reduced, and zero-rated sales, plus some exempt income such as rent or commissions. You calculate your flat rate on this total, not just the net (pre-VAT) amount.

2. Do I pay FRS on zero-rated and exempt sales?

Yes. You still apply your flat rate percentage to the total turnover, even if some sales are zero-rated or VAT-exempt. That's why the flat rate is set lower than the standard 20%, as it averages out different VAT types.

3. Who can't join the scheme?

You can't join if your VAT-taxable turnover is expected to exceed £150,000 (excluding VAT) in the next 12 months, or if your total income is over £230,000 (including VAT). You're also ineligible if you've left the scheme within the past 12 months, committed a VAT-related offence in the last 12 months, or operate under margin schemes, TOMS, VAT groups/divisions, or domestic reverse charge sectors.

4. What is a limited-cost trader, and how do I test it?

You're a limited-cost trader if your spending on goods is less than 2% of your VAT-inclusive turnover, or more than 2% but under £1,000 per year (adjusted for shorter periods). If that's the case, you must use the 16.5% flat rate regardless of your industry.

5. Can I reclaim input VAT on a laptop under £2,000?

No. Input VAT can only be reclaimed on a single capital purchase worth £2,000 or more (including VAT) on one invoice. Smaller items like laptops under this threshold are covered under your flat rate and can't be reclaimed.

6. How does the 1% first-year reduction work?

Newly VAT-registered businesses get a 1% discount on their chosen flat rate for the first 12 months of VAT registration (not from the date of joining FRS). For instance, if your rate is 12%, you'll pay 11% for that first year.

7. Can I use FRS with Cash Accounting or Retail Schemes?

You can't combine FRS with standard Cash Accounting or Retail Schemes. However, the FRS includes its own cash-based method and retailer's turnover method, which are similar but must be applied under FRS rules.

8. How do I leave, and when must I?

You must leave when your annual turnover (including VAT) goes above £230,000, or if you expect to exceed that in the next 30 days. You can also leave voluntarily by notifying HMRC in writing or online. Once you leave, you must stay out for 12 months before rejoining.

9. What happens if I pick the wrong sector?

HMRC won't penalise you if your sector choice was reasonable based on available information. Keep a written note explaining your decision. But if your choice was clearly incorrect and resulted in underpayment, HMRC can recalculate your VAT and apply interest or penalties.

10. Does FRS work for high-goods traders?

Usually not. Businesses that buy or import many standard-rated goods (e.g., manufacturers, retailers) often pay more VAT under FRS because they can't reclaim input VAT. It's better suited for service-based firms with low goods spending.

11. How do imports with postponed VAT accounting affect FRS?

Since June 2022, businesses using postponed VAT accounting must exclude the import value from their FRS turnover. Instead, report the import VAT in Box 1 after the FRS calculation to avoid double-counting.

12. Can HMRC challenge my rate?

Yes. HMRC can question your flat rate percentage if they believe your chosen sector doesn't match your actual activity. You may need to provide records and reasoning to justify your selection.

Conclusion

The VAT Flat Rate Scheme keeps VAT simple. You charge customers as normal. You then pay HMRC a fixed percentage of your VAT-inclusive turnover. It suits service-heavy firms with low spend on goods. It's weaker where input VAT is high.

Our analysis shows three smart checks before you choose:

- 1.Run the limited-cost trader test.

- 2.Compare FRS vs Standard VAT on your last quarter.

- 3.Factor in the 1% first-year discount and any capital goods over £2,000.

✅ Best For:

- •Service-heavy firms with low spend on goods

- •Businesses wanting simplified VAT admin

- •Consultants, designers, professionals

❌ Not Ideal For:

- •Businesses with high input VAT

- •Manufacturers and retailers with stock

- •Limited-cost traders (unless carefully checked)

If you buy lots of goods, Standard VAT often wins. If your costs are light, FRS can save time and money. According to Mirza Shafique at vatukcalculator.com, most mistakes come from using net sales instead of VAT-inclusive totals, or missing the limited-cost rule.

Use the calculator above to compare your options, or try our standard VAT calculator to make the right choice for your business.

Read more about VAT strategies and tax management tips on our blog to optimize your tax compliance.