Enter an amount and click Calculate to see results

Looking to work out VAT quickly? Our free VAT Calculator helps you add or remove VAT from any amount in seconds. It's designed for business owners, accountants, and everyday shoppers who want fast and accurate tax results without doing the math by hand.

Simply enter your price, choose the VAT rate, and get instant calculations. The tool supports standard rates like 20% in the UK, but you can adjust for any country or custom percentage.

According to vatukcalculator.com, most users save valuable time by relying on automated VAT tools instead of manual calculations, and many also look for simple steps on How to Claim VAT Refund UK when they want to understand refund rules fast.

No sign-up, no downloads—just a simple calculator for net, gross, and VAT amounts.

Get VAT calculations in seconds with no delays

Support for UK, EU & worldwide VAT rates

Perfect experience on all devices

This tool is simple to use. Follow these quick steps and get your results in seconds:

You can start with either a net price (without tax) or a gross price (with tax).

The default is 20%, but you can also pick reduced rates like 5% or enter a custom percentage for other countries. For more details, you can also check the UK VAT rates guide, especially if you want a clear answer to how much is VAT in the UK and how the rate applies in daily costs.

Choose whether you want to add VAT to a net price or remove VAT from a gross price.

The calculator shows the net amount, VAT amount, and gross total in one clear view.

Input: £100 net and select 20% VAT

Result: £20 VAT and a £120 gross total

You can also start with the gross value and press Enter to get VAT and net instantly. Our analysis shows that most users prefer tools that provide instant add or remove VAT options without extra steps. That's why this calculator is optimized for speed and accuracy, and many readers also check How to Use the VAT Calculator UK when they want a simple guide for quick steps.

.webp?w=828)

Adding or removing VAT is simple once you know the formulas. Whether it's 5%, 12%, 15%, or 20%, the calculation follows the same steps. These examples give you clear values for net, tax, and gross, making VAT results easy to understand.

Formula:

Example:

£100 × (1 + 20%) = £120

VAT = £20, Gross = £120

Formula:

Example:

£120 ÷ (1 + 20%) = £100

VAT = £20, Net = £100

Add VAT

Net × (1 + %) = Gross

Remove VAT

Gross ÷ (1 + %) = Net

Find VAT Value

Gross – Net = VAT

5% VAT Rate

Net £200 × 1.05 = £210 → VAT = £10

12% VAT Rate

Net £300 × 1.12 = £336 → VAT = £36

15% VAT Rate

Net £500 × 1.15 = £575 → VAT = £75

20% VAT Rate

Net £1000 × 1.20 = £1200 → VAT = £200

| Net Price | VAT Rate | VAT Amount | Gross Price |

|---|---|---|---|

| £200 | 5% | £10 | £210 |

| £300 | 12% | £36 | £336 |

| £500 | 15% | £75 | £575 |

| £1000 | 20% | £200 | £1200 |

Many online calculators show VAT instantly when you press the calculate or Enter button, avoiding manual rounding steps.

VAT is a consumption tax collected at each step of the supply chain. Unlike sales tax, it spreads the tax load and avoids double taxation. Some countries call it VAT, others call it GST, but the purpose is the same—taxing the final consumer purchase. Globally, VAT raises about 20% of all tax revenue and is active in more than 160 countries.

VAT, or Value Added Tax, is a type of consumption tax. It applies to most goods and services at each stage of production and distribution. While businesses collect VAT, the final cost is always paid by the end consumer.

In simple terms, VAT is an indirect tax. Instead of paying it directly to the government, consumers pay it when they buy products or services. Businesses act as collectors and pass the amount to tax authorities.

VAT is different from sales tax. Sales tax is charged only at the final sale to the consumer, while VAT is charged at each stage of the supply chain. This prevents "tax on tax" or cascading effects.

According to Mirza Shafique, VAT systems are considered more transparent and fair because each business only pays tax on the value it adds.

In many countries, VAT is known as GST (Goods and Services Tax). For example, India, Canada, and Australia use GST systems that work in a similar way to VAT. The terms may differ, but the logic is the same: tax on consumption.

Based on our findings at vatukcalculator.com, VAT and GST are two names for the same principle, but their rules and rates vary by country.

Let's use a simple coffee example:

Step 1: Farmer

A farmer sells coffee beans for £1 + 20% VAT = £1.20.

Step 2: Roaster

A roaster buys, processes, and sells the beans for £3 + VAT = £3.60.

Step 3: Café

A café buys the roasted beans, makes a drink, and sells it for £5 + VAT = £6.

At every stage, VAT is collected and reported, but only the value added at that stage is taxed. The consumer, in the end, pays the full VAT.

.webp?w=828)

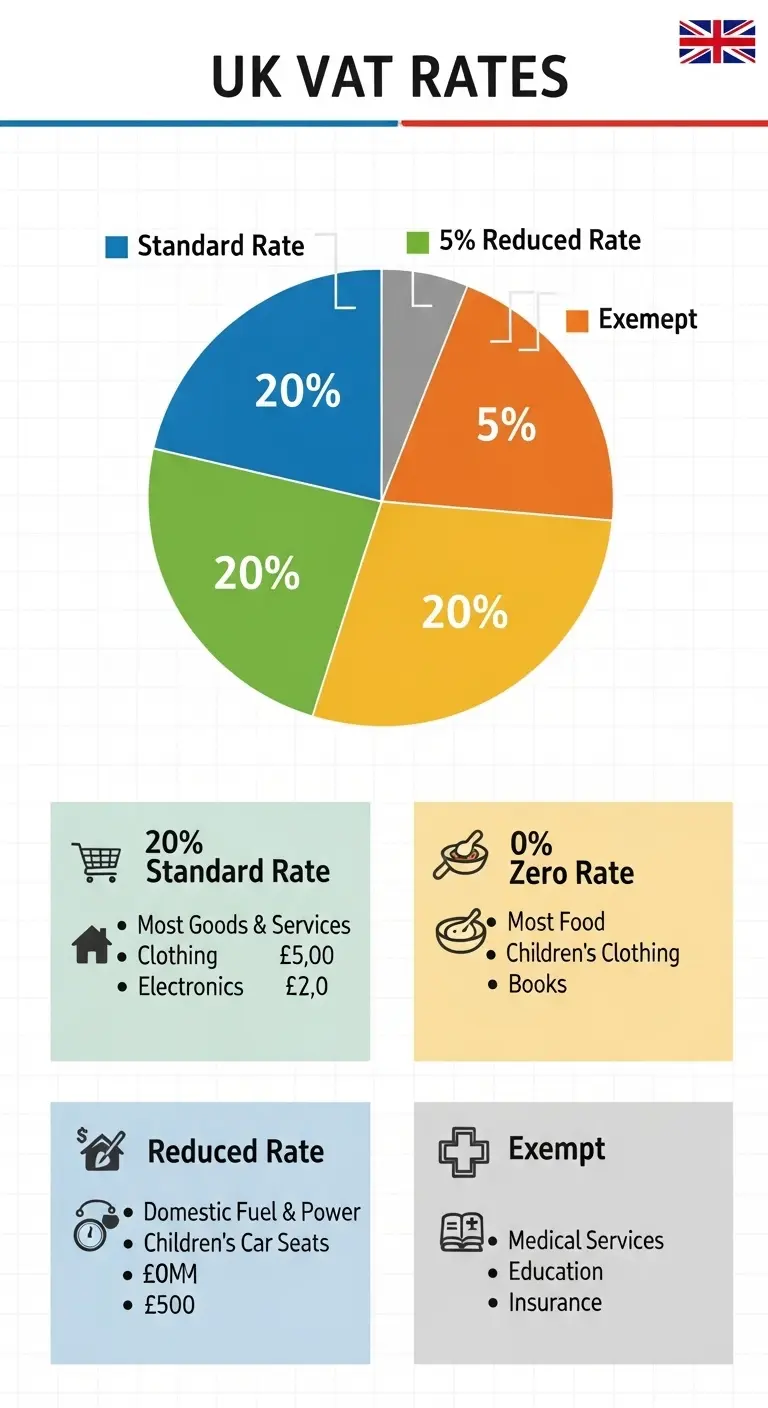

The UK applies a 20% standard rate with reduced, zero, and exempt categories. Businesses crossing the £85,000 turnover threshold must register. VAT has been part of the UK system since 1973, with changes linked to economic conditions. Some supplies, like education and healthcare, remain exempt.

VAT plays a major role in the UK tax system. It affects almost every business, product, and service. Below is a full guide to current rates, registration rules, history, and exemptions.

| Rate Type | Percentage | Applies To |

|---|---|---|

| Standard Rate | 20% | Most goods and services, including retail, hospitality, and digital products |

| Reduced Rate | 5% | Domestic fuel, energy-saving materials, children's car seats, and some health-related items |

| Zero Rate | 0% | Food, books, newspapers, children's clothes, and medicines |

| Exempt Supplies | N/A | Education, healthcare, insurance, postal services, and some property transactions |

Based on Mirza Shafique's analysis at vatukcalculator.com, businesses must always confirm the category of their goods or services before applying VAT, as errors can lead to penalties.

Businesses must register for VAT if their taxable turnover exceeds £85,000 in a 12-month period. Voluntary registration is also possible if turnover is below this limit but the business wants to reclaim VAT on purchases.

According to our findings, many small businesses benefit from early registration because it builds trust with clients and allows VAT reclaims on business expenses.

| Year | Rate | Event |

|---|---|---|

| 1973 | 10% | VAT introduced, replacing Purchase Tax |

| 1974 | 8% | Reduced rate |

| 1979 | 15% | Increased rate |

| 1991 | 17.5% | Standard rate increase |

| 2008 | 15% | Temporary cut during financial crisis |

| 2010 | 17.5% | Returned to previous rate |

| 2011 | 20% | Current standard rate |

In 2008, VAT dropped to 15% for 13 months as a £12.5 billion stimulus during the financial crisis. This timeline shows how VAT has been adjusted to meet economic needs and government policies.

Our analysis shows that exemptions are often misunderstood. Businesses should check carefully before classifying sales as exempt, since mistakes can trigger compliance issues.

.webp?w=828)

VAT only makes sense when you see it in action. Below are three simple case studies showing how businesses and consumers deal with VAT in real life.

Imagine a customer buying a laptop in London for £1,200 including VAT.

Net Price (before VAT): £1,000

VAT (20%): £200

Gross Price (paid by customer): £1,200

The retailer collects the £200 VAT and passes it to HMRC. The customer pays the full £1,200.

UK Retail Invoice Breakdown

| Item | Net Price | VAT (20%) | Gross Price |

|---|---|---|---|

| Laptop Sale | £1,000 | £200 | £1,200 |

A single cup of coffee shows VAT at different supply stages:

Coffee Supply Chain VAT Breakdown

| Stage | Net Price | VAT (20%) | Gross Price | Who Pays VAT? |

|---|---|---|---|---|

| Farmer → Roaster | £100 | £20 | £120 | Roaster pays farmer, claims £20 back |

| Roaster → Café | £200 | £40 | £240 | Café pays roaster, claims £40 back |

| Café → Consumer | £300 | £60 | £360 | Consumer pays final £60 (cannot reclaim) |

In some countries, like the Philippines, senior citizens are exempt from VAT on most personal goods and services.

A UK seller ships software to a German business.

The same UK seller ships to a German customer (no VAT ID).

For cross-border sales, VAT treatment depends on whether it's B2B or B2C. Always check the buyer type and applicable regulations.

This tool is helpful for professionals, businesses, and everyday shoppers. It ensures accurate tax results in seconds.

This tool isn't just for accountants. It's useful for many groups who deal with tax in daily life:

Freelancers and contractors

Quickly work out VAT for invoices and avoid undercharging clients.

Small businesses and startups

Stay compliant with VAT rules without wasting time on manual calculations.

E-commerce sellers

Calculate the correct VAT for sales in different countries and keep checkout prices accurate.

Accountants and auditors

Speed up bulk VAT entries and cross-check numbers with less effort.

Consumers

Double-check receipts and know exactly how much tax was included in a purchase.

Based on our findings, most people use these tools to save time and prevent mistakes. Whether you're running a business or just buying goods, having the right VAT value makes life easier.

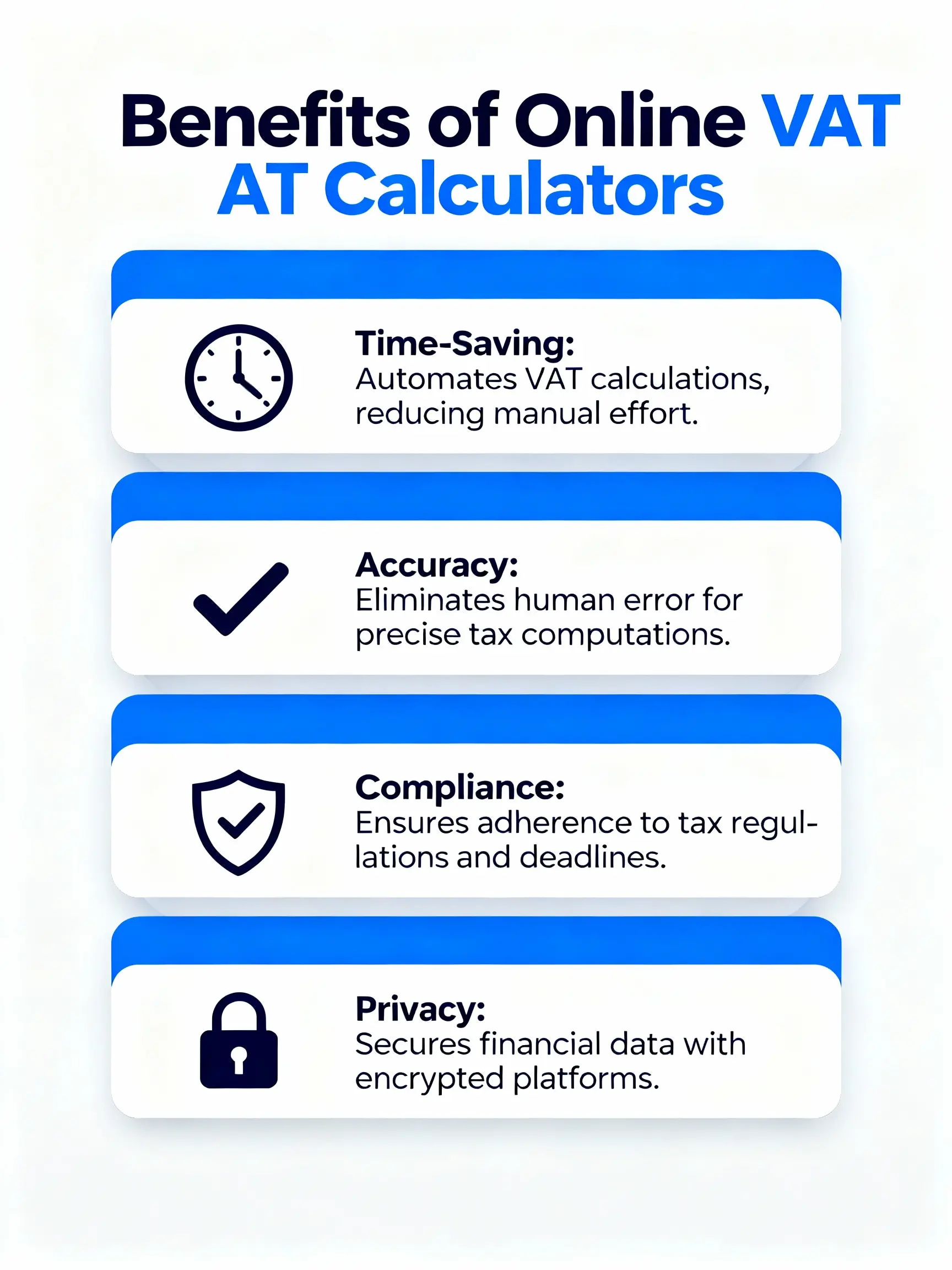

This tool saves time, improves accuracy, and supports compliance. It outperforms manual methods in every way, making it a must-have tool for businesses and consumers.

Using this online tool brings real advantages for both businesses and individuals.

Saves time and prevents mistakes

Works for invoices, receipts, and audits

Supports different rates and countries

Improves compliance

Privacy-friendly - no personal data stored

According to Mirza Shafique, many businesses rely on these tools not just for speed but also for better compliance with global tax laws. This makes them essential tools for both local and international trade.

| Factor | Manual Calculation | VAT Calculator Tool |

|---|---|---|

| Speed | Slow, especially for bulk data | Instant results in seconds |

| Accuracy | Risk of errors in math | Error-free and consistent |

| Multiple Rates | Hard to adjust each time | Adjusts instantly for any country |

| Compliance | Easy to misapply tax rules | Keeps rates aligned with government |

| Ease of Use | Requires formulas and effort | Simple input → instant output |

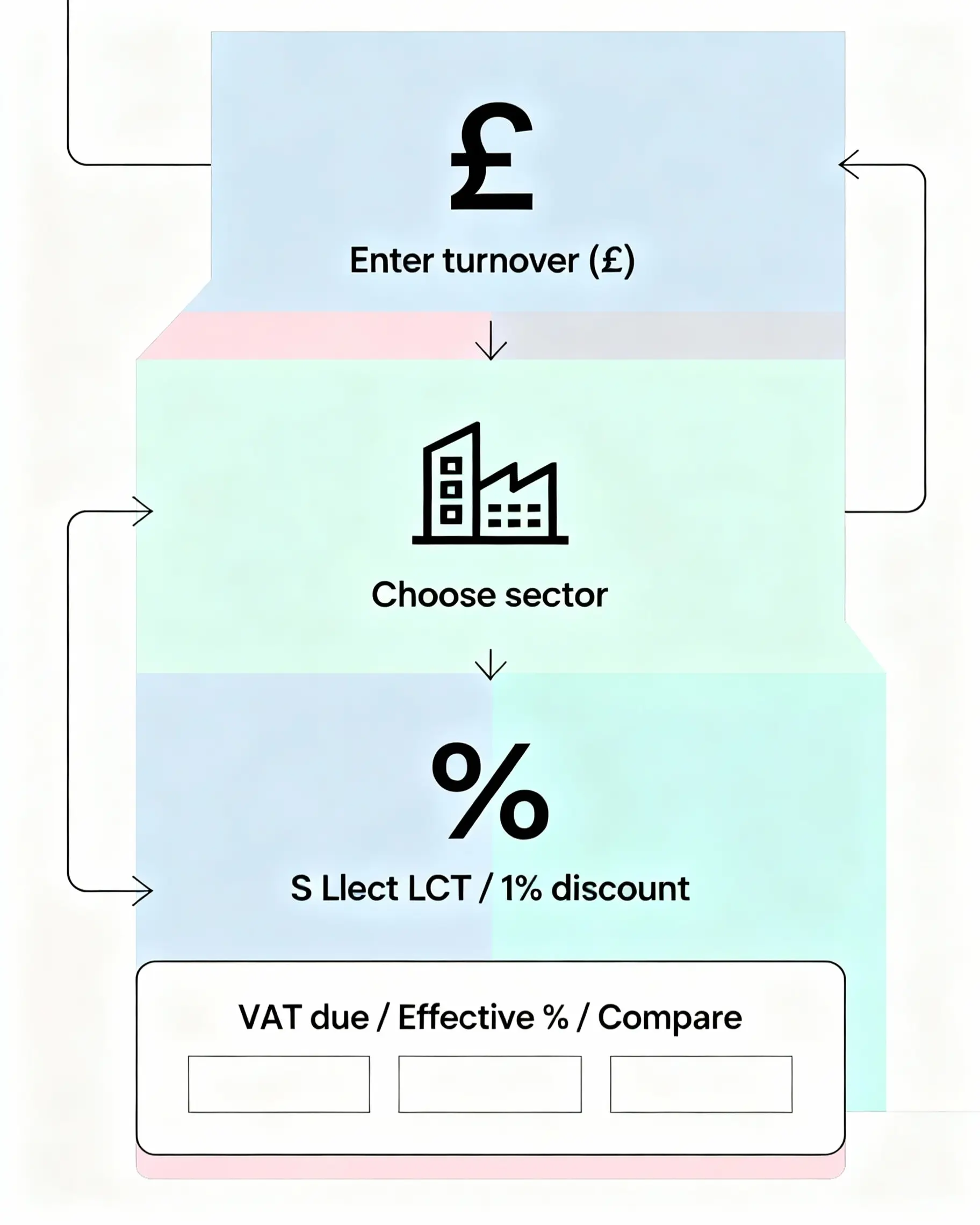

If you're a small business in the UK with an annual turnover under £150,000, the VAT Flat Rate Scheme could simplify your VAT obligations significantly. Instead of tracking input and output VAT on every transaction, you pay a fixed percentage of your total turnover directly to HMRC.

The flat rate varies by business type—from 4% for food retailers to 14.5% for accountants and consultants. This system saves time on record-keeping and can reduce your VAT bill if your input VAT is typically low. It's especially beneficial for service-based businesses.

Our dedicated Flat Rate Calculator shows you exactly how much VAT you'd owe under this scheme, compares it with standard VAT, and helps you decide if it's the right choice for your business.

This tool is just one part of financial planning. Pairing it with tools like sales tax, GST, or income tax tools gives a full picture of costs and compliance.

Alongside VAT, businesses and consumers often deal with other taxes and financial calculations. To make things easier, here are some useful tools:

Works for states like California, Texas, and New York where sales tax varies by region.

Helps in countries such as India, Canada, and Australia where Goods and Services Tax applies instead of VAT.

Useful for employees and freelancers to estimate yearly tax obligations.

Designed for the UK, helping workers see net salary after deductions.

For companies that need to project profits after business taxes.

Support long-term financial planning by showing repayment schedules and retirement values.

Stripe Tax can also calculate VAT by country, keeping tax rules updated for international compliance. Based on our findings, users often combine VAT tools with income tax and GST systems. This creates a complete view of both personal and business finances.

Our VAT Calculator is designed to give quick and reliable estimates, but it should be used as a guidance tool only. It does not replace official government rules or professional tax advice.

VAT rules can change depending on the country, type of goods or services, and business setup. Even a small mistake in reporting may lead to penalties or audits.

Based on our findings, most businesses benefit from using online tools for fast checks, but final decisions should always be confirmed with a qualified accountant or tax advisor.

According to Mirza Shafique at vatukcalculator.com, calculators like this are helpful for day-to-day tasks, but they cannot cover every legal exception.

For example, exemptions in education, healthcare, or cross-border sales often need a case-by-case review. Always verify with local tax authorities for the most current regulations.

VAT can seem complicated, but with the right tool it becomes quick and stress-free. Our free VAT Calculator gives you instant net, gross, and tax values without needing to remember formulas or do manual math.

Whether you're a freelancer making invoices, a small business staying compliant, or a shopper double-checking receipts, this calculator is built to save time and prevent mistakes.

According to Mirza Shafique at vatukcalculator.com, most users prefer online VAT tools because they deliver accuracy and speed that manual methods simply can't match.

To add VAT, multiply the net amount by the VAT rate (e.g., 20%). For example, £100 × 1.20 = £120. The calculator gives you the VAT and total instantly.

To get the net amount from a VAT-inclusive price, divide by 1.20 (for 20% VAT). For example, £120 ÷ 1.20 = £100. The calculator does this in seconds without manual math.

The UK has three main rates: 20% (standard), 5% (reduced, e.g., energy bills), and 0% (zero-rated, e.g., food and books). Some goods and services are exempt.

A VAT-inclusive price already has VAT added (final price you pay). A VAT-exclusive price shows the base amount, with VAT added later at checkout or on the invoice.

When a price already includes 20% VAT, dividing by 1.20 removes the tax and gives the original net amount. This is a quick reverse calculation method.

Yes. Incorrect VAT on invoices or returns can lead to fines, repayment demands, or compliance issues with HMRC. Using a VAT calculator helps avoid errors.